estate tax exemption 2022 build back better

For 2022 the inflation-adjusted federal estate gift and GST tax exemption amounts are 1206 million for an individual up. Due to inflation the estate tax exemption has.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

5376 contains no modifications to the estate and gift tax exclusion amount or the basis step up rules.

. 28 2021 President Joe Biden announced a framework for changes to the US. Gift and Estate Taxes Proposed Under the Build Back Better Act. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000.

Estate Taxes One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service. Federal transfer tax developments Exemption amounts and rates.

The exclusion amount is for 2022 is 1206. For 2021 the exemption amount was set at 117 million dollars for individuals and double that amount for married couples. The BBBA proposal seeks to reduce these.

While many may breathe a sigh of relief. The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. This was anticipated to drop to 5 million adjusted for inflation as of January 1.

As we discussed in more detail here Congress previously proposed as part of the Build Back Better Act accelerating the sunset of the exemption to January 1 2022 and. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Build Back Better Act.

For 2022 and after reducing the current exemption by half for 2022-2025. A reduction in the federal estate tax exemption amount which is currently 11700000. The Joint Committee on Taxation JCT estimates this provision to raise 543 billion for FY2022- FY2031.

The package proposed reducing the current 117 million estategift tax exemption by 50 percent on january 1 2022 eliminating the use of valuation discounts for non-operating. The revised bill does not include this. The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022.

The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Without Section 2032A the farmers family would owe about 48 million in estate taxes assuming the personal exemption now 117 million is lowered to about 6 million in. A later House of Representatives proposal sought to increase the capital gains tax rate and cut the estate and gift tax exemption in half in 2022.

The new exemption amount. The Build Back Better Act HR. Lowering the gift and estate tax exemptions seems a lock.

Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan.

A Revised Framework For The Build Back Better Bill Accounting Today

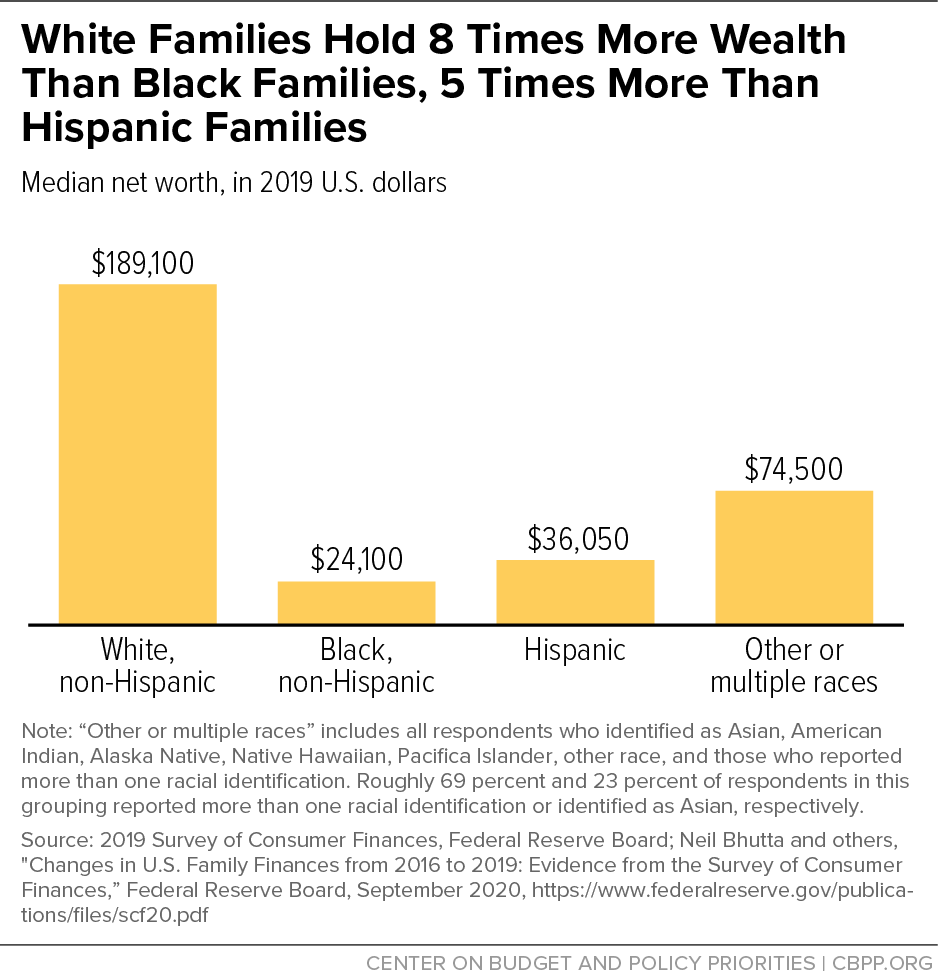

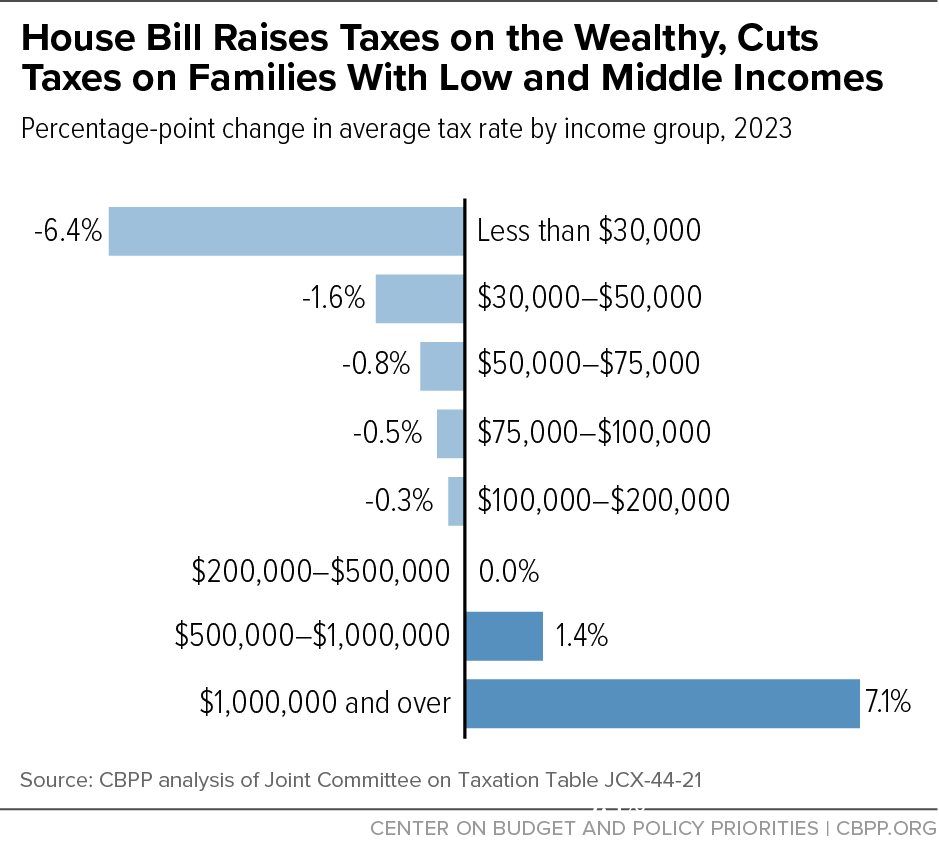

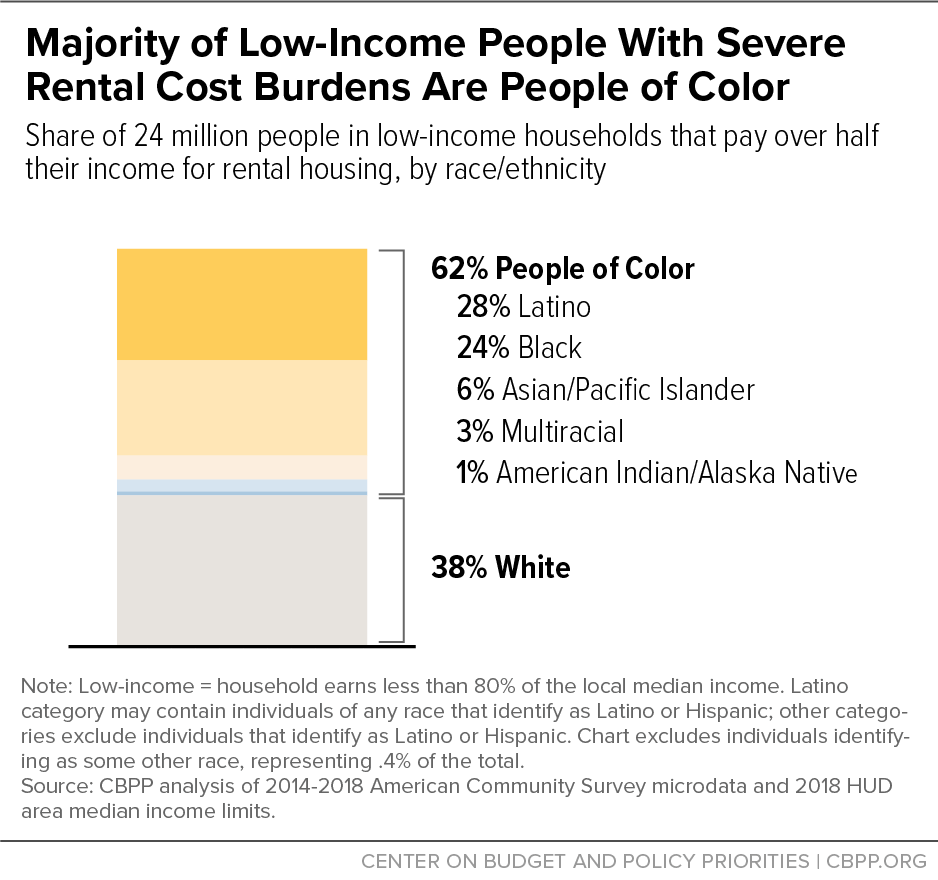

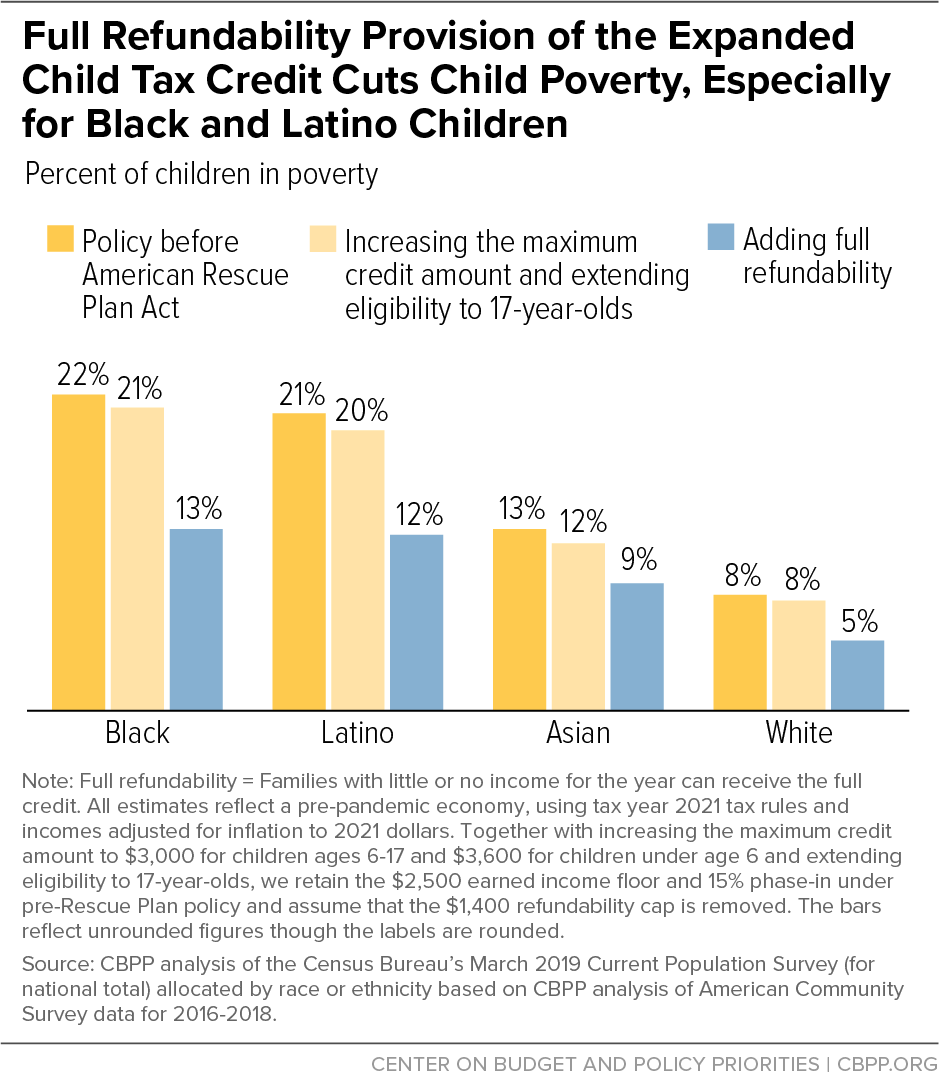

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

A Revised Framework For The Build Back Better Bill Accounting Today

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Biden S Bill Funds Niche Items From Electric Bikes To Tree Equity The New York Times

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

As Inflation Rises At Record Pace What Impact Could Biden S Build Back Better Plan Have Fox Business

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities